Company at a Glance

Price

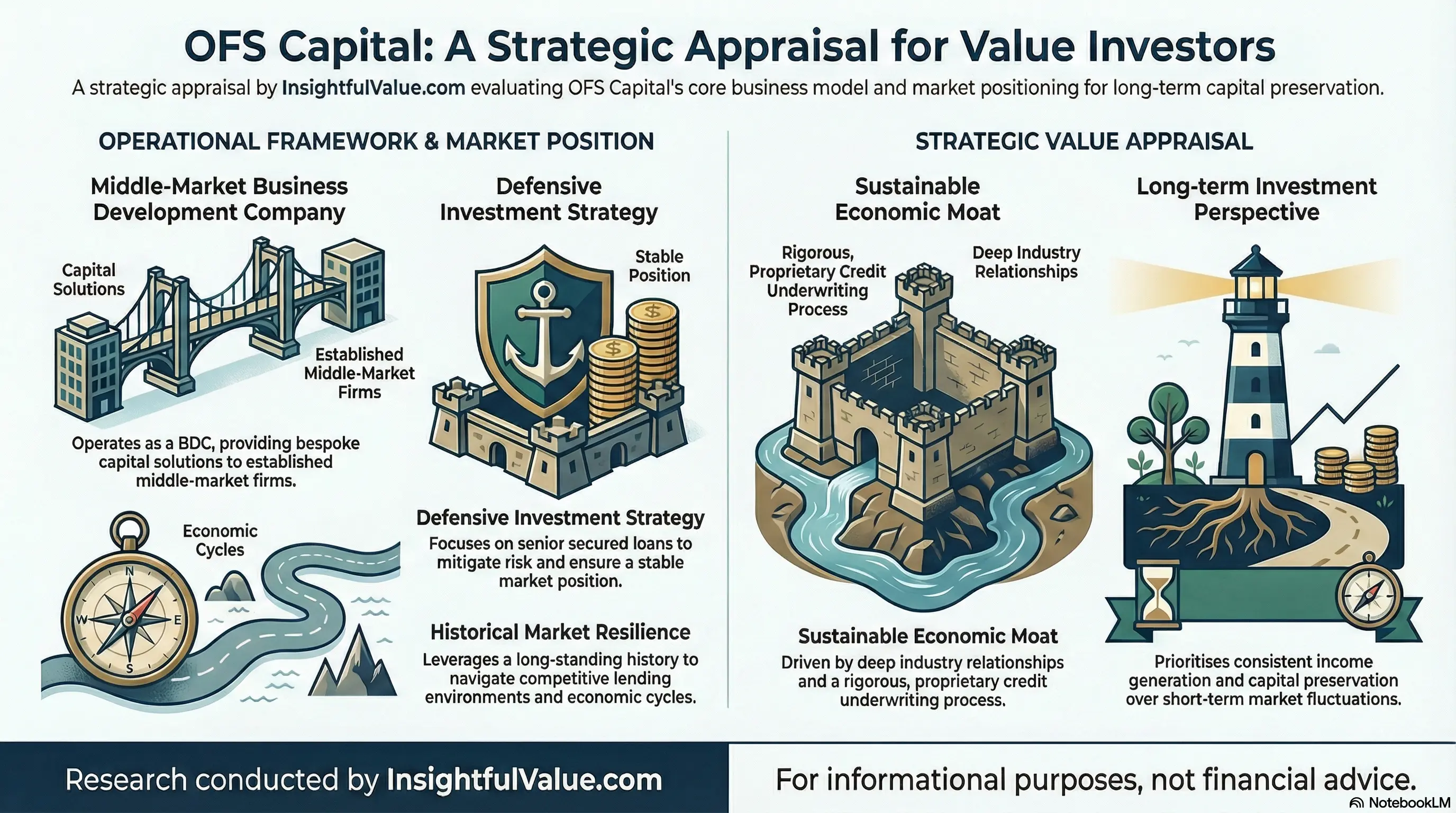

Infographic

Overview

OFS Capital is a publicly traded business development company (BDC) that provides innovative, flexible, and customized financing solutions to middle-market companies. The company was founded in 2006 and is headquartered in Chicago, Illinois.

The company’s primary objective is to provide capital to large and well-established companies through various forms of debt and equity investments. By providing financing solutions to middle-market companies, OFS Capital helps these businesses grow and expand.

The company specializes in providing senior secured loans, subordinated debt, and equity investments to companies across various industries, including healthcare, business services, and industrial products. OFS Capital also offers customized financing solutions, such as mezzanine loans, unitranche facilities, and equity co-investments.

OFS Capital is externally managed by OFS Capital Management LLC, a subsidiary of OFS Capital Corporation, and has a team of experienced professionals with a strong track record in middle-market lending and investing.

OFS Capital’s investment strategy is focused on identifying companies with stable cash flows, strong management teams, and growth potential. The company also aims to maintain a diversified portfolio of investments to minimize risk and maximize returns for its shareholders.

In addition to its core business of providing financing solutions, OFS Capital also actively manages its portfolio of investments to ensure optimal performance. The company monitors its investments regularly and works closely with its portfolio companies to provide strategic and operational support.

OFS Capital is listed on the Nasdaq Global Select Market under the ticker symbol OFS.

What is special about the company?

📈 Want to read more about OFS Capital?

Sign up for free

or

log in

🔓 Unlock our free guide: "The Checklist Value Investor — A Smarter Way to Pick Stocks"

T0ZTIENhcG l0YWwgQ29y cG9yYXRpb2 4gaXMgYSBi dXNpbmVzcy BkZXZlbG9w bWVudCBjb2 1wYW55IHRo YXQgc3BlY2 lhbGl6ZXMg aW4gcHJvdm lkaW5nIGZp bmFuY2luZy Bzb2x1dGlv bnMgdG8gbW lkZGxlLW1h cmtldCBjb2 1wYW5pZXMg aW4gdGhlIG Zvcm0gb2Yg ZGVidCBhbm QgZXF1aXR5 IGludmVzdG 1lbnRzLiBJ dCBmb2N1c2 VzIG9uIHBh cnRuZXJpbm cgd2l0aCBl c3RhYmxpc2 hlZCBhbmQg Z3Jvd2luZy Bjb21wYW5p ZXMgd2l0aC BhIHN0cm9u ZyBtYW5hZ2 VtZW50IHRl YW0sIHN0YW JsZSBjYXNo IGZsb3dzLC BhbmQgYSB0 cmFjayByZW NvcmQgb2Yg cGVyZm9ybW FuY2UuIFRo aXMgY29tcG FueSBhbHNv IHByb3ZpZG VzIGN1c3Rv bWl6ZWQgYW 5kIGZsZXhp YmxlIGZpbm FuY2luZyBv cHRpb25zIH RvIG1lZXQg dGhlIHNwZW NpZmljIG5l ZWRzIG9mIG l0cyBjbGll bnRzLiA8Yn I+U29tZSBv dGhlciB1bm lxdWUgYXNw ZWN0cyBvZi BPRlMgQ2Fw aXRhbCBDb3 Jwb3JhdGlv biBpbmNsdW RlOjxicj4x LiBFeHBlcm llbmNlZCBN YW5hZ2VtZW 50IFRlYW06 IFRoZSBjb2 1wYW55IGlz IGxlZCBieS BhIGhpZ2hs eSBleHBlcm llbmNlZCBt YW5hZ2VtZW 50IHRlYW0g d2l0aCBhIH N0cm9uZyB0 cmFjayByZW NvcmQgb2Yg c3VjY2Vzcy BpbiB0aGUg aW52ZXN0bW VudCBhbmQg ZmluYW5jaW FsIHNlcnZp Y2VzIGluZH VzdHJ5Ljxi cj4yLiBOaW NoZSBGb2N1 czogT0ZTIE NhcGl0YWwg c3BlY2lhbG l6ZXMgaW4g dGhlIGxvd2 VyIG1pZGRs ZS1tYXJrZX Qgc2VnbWVu dCwgd2hpY2 ggaXMgb2Z0 ZW4gb3Zlcm xvb2tlZCBi eSBsYXJnZX IgZmluYW5j aWFsIGluc3 RpdHV0aW9u cy4gVGhpcy BnaXZlcyB0 aGVtIGEgY2 9tcGV0aXRp dmUgYWR2YW 50YWdlIGlu IGlkZW50aW Z5aW5nIGFu ZCBpbnZlc3 RpbmcgaW4g aGlnaC1wb3 RlbnRpYWwg Y29tcGFuaW VzLjxicj4z LiBEaXZlcn NlIEludmVz dG1lbnQgUG 9ydGZvbGlv OiBUaGUgY2 9tcGFueSBo YXMgYSBkaX ZlcnNlIHBv cnRmb2xpby BvZiBpbnZl c3RtZW50cy BhY3Jvc3Mg dmFyaW91cy BpbmR1c3Ry aWVzIGFuZC BzZWN0b3Jz LCByZWR1Y2 luZyByaXNr IGFuZCBwcm 92aWRpbmcg cG90ZW50aW FsIGZvciBn cm93dGguPG JyPjQuIEFj Y2VzcyB0by BDYXBpdGFs OiBPRlMgQ2 FwaXRhbCBo YXMgYWNjZX NzIHRvIGEg dmFyaWV0eS BvZiBmaW5h bmNpbmcgc2 91cmNlcywg aW5jbHVkaW 5nIGl0cyBv d24gY2FwaX RhbCwgdG8g cHJvdmlkZS BjdXN0b21p emVkIHNvbH V0aW9ucyB0 byBpdHMgY2 xpZW50cy48 YnI+NS4gQW N0aXZlIElu dmVzdG1lbn QgTWFuYWdl bWVudDogVG hlIGNvbXBh bnkgdGFrZX MgYSBwcm9h Y3RpdmUgYX Bwcm9hY2gg dG8gbWFuYW dpbmcgaXRz IGludmVzdG 1lbnRzLCBw cm92aWRpbm cgb25nb2lu ZyBzdXBwb3 J0IGFuZCBn dWlkYW5jZS B0byBpdHMg cG9ydGZvbG lvIGNvbXBh bmllcyB0by BoZWxwIGRy aXZlIGdyb3 d0aCBhbmQg bWF4aW1pem UgcmV0dXJu cy48YnI+Ni 4gRW1waGFz aXMgb24gUm lzayBNYW5h Z2VtZW50Oi BPRlMgQ2Fw aXRhbCBoYX MgYSBkaXNj aXBsaW5lZC ByaXNrIG1h bmFnZW1lbn Qgc3RyYXRl Z3kgaW4gcG xhY2UsIGZv Y3VzaW5nIG 9uIHRob3Jv dWdoIGR1ZS BkaWxpZ2Vu Y2UgYW5kIG 1haW50YWlu aW5nIGEgd2 VsbC1kaXZl cnNpZmllZC Bwb3J0Zm9s aW8gdG8gbW l0aWdhdGUg cmlzay48Yn I+Ny4gSW52 ZXN0b3ItRn JpZW5kbHkg U3RydWN0dX JlOiBUaGUg Y29tcGFueS BpcyBzdHJ1 Y3R1cmVkIG FzIGEgcmVn dWxhdGVkIG ludmVzdG1l bnQgY29tcG FueSAoUklD KSwgd2hpY2 ggb2ZmZXJz IHRheCBhZH ZhbnRhZ2Vz IGZvciBpbn Zlc3RvcnMg c3VjaCBhcy B0YXgtZnJl ZSBkaXZpZG VuZHMgYW5k IGEgcG90ZW 50aWFsIHJl ZHVjdGlvbi BpbiB0YXgg bGlhYmlsaX R5Ljxicj5P dmVyYWxsLC B3aGF0IHNl dHMgT0ZTIE NhcGl0YWwg YXBhcnQgaX MgaXRzIG5p Y2hlIGZvY3 VzLCBleHBl cmllbmNlZC BtYW5hZ2Vt ZW50IHRlYW 0sIGFuZCBj b21wcmVoZW 5zaXZlIGFw cHJvYWNoIH RvIGludmVz dG1lbnQgbW FuYWdlbWVu dCwgbWFraW 5nIGl0IGEg dW5pcXVlIG FuZCBhdHRy YWN0aXZlIG ludmVzdG1l bnQgb3B0aW 9uIGZvciBi b3RoIGNvbX BhbmllcyBh bmQgaW52ZX N0b3JzLg==

What the company's business model?

📈 Want to read more about OFS Capital?

Sign up for free

or

log in

🙌 Join now to get "The Checklist Value Investor — A Smarter Way to Pick Stocks" at no cost

T0ZTIENhcG l0YWwgaXMg YSBsZWFkaW 5nIGJ1c2lu ZXNzIGRldm Vsb3BtZW50 IGNvbXBhbn kgdGhhdCBw cm92aWRlcy BmaW5hbmNp bmcgc29sdX Rpb25zLCBp bmNsdWRpbm cgZGVidCBh bmQgZXF1aX R5IGludmVz dG1lbnRzLC B0byBtaWRk bGUtbWFya2 V0IGNvbXBh bmllcy4gVG hlIGNvbXBh bnnigJlzIG J1c2luZXNz IG1vZGVsIG lzIHByaW1h cmlseSBmb2 N1c2VkIG9u IGxlbmRpbm cgdG8gYW5k IGludmVzdG luZyBpbiBl c3RhYmxpc2 hlZCwgZ3Jv d2luZyBjb2 1wYW5pZXMg d2l0aCBzdH JvbmcgbWFu YWdlbWVudC B0ZWFtcyBh bmQgYSBoaX N0b3J5IG9m IHN0YWJsZS BlYXJuaW5n cy4gT0ZTIE NhcGl0YWwg dHlwaWNhbG x5IHRhcmdl dHMgY29tcG FuaWVzIHdp dGggYW5udW FsIHJldmVu dWVzIGJldH dlZW4gJDEw IG1pbGxpb2 4gYW5kICQy NTAgbWlsbG lvbi4gVGhl eSBhbHNvIG hhdmUgYSBm b2N1cyBvbi BpbnZlc3Rp bmcgaW4gY2 9tcGFuaWVz IGluIHRoZS BoZWFsdGhj YXJlIGFuZC BpbmR1c3Ry aWFsIHNlY3 RvcnMuIFRo ZSBjb21wYW 554oCZcyBn b2FsIGlzIH RvIHByb3Zp ZGUgZmxleG libGUgYW5k IGN1c3RvbW l6ZWQgZmlu YW5jaW5nIG 9wdGlvbnMg dG8gaGVscC B0aGVpciBw b3J0Zm9saW 8gY29tcGFu aWVzIGFjaG lldmUgdGhl aXIgZ3Jvd3 RoIGFuZCBl eHBhbnNpb2 4gb2JqZWN0 aXZlcy4gQW RkaXRpb25h bGx5LCBPRl MgQ2FwaXRh bCBzZWVrcy B0byBnZW5l cmF0ZSBhdH RyYWN0aXZl IHJldHVybn MgZm9yIGl0 cyBpbnZlc3 RvcnMgYnkg Y2FyZWZ1bG x5IG1hbmFn aW5nIGl0cy BpbnZlc3Rt ZW50cyBhbm QgbWFpbnRh aW5pbmcgYS BkaXZlcnNl IHBvcnRmb2 xpby4=

Sensitivity to interest rates

The sensitivity of OFS Capital’s earnings, cash flow, and valuation to changes in interest rates can be analyzed in several ways:

1. Earnings: OFS Capital’s earnings are influenced by the rates at which it can borrow and lend. If interest rates rise, the cost of borrowing increases for the company, which can pressure profit margins on its loans. Additionally, if the company holds fixed-rate assets, rising rates may reduce the market value of these assets, impacting reported earnings. Conversely, higher interest rates could allow the company to charge more on new loans, potentially increasing income if managed effectively.

2. Cash Flow: Cash flow can also be significantly affected by interest rate fluctuations. Higher interest expenses may reduce net cash flow from operations if the company has substantial variable-rate debt. If rates increase, cash outflows related to interest payments will rise, which could limit the company’s ability to reinvest or distribute dividends. Additionally, changes in economic conditions associated with fluctuating interest rates can influence borrower behavior, impacting repayment rates and defaults.

3. Valuation: The valuation of OFS Capital is typically based on discounted cash flow models and market comparisons. Higher interest rates generally lead to higher discount rates used in valuation models, which can reduce the present value of future cash flows and, therefore, the overall valuation of the company. The increase in rates may also prompt investors to seek higher returns elsewhere, potentially leading to a decline in the market price of OFS Capital’s shares.

In conclusion, OFS Capital’s earnings, cash flow, and valuation are sensitive to interest rate changes. Rising rates can lead to increased costs and reduced cash flows, thereby affecting earnings and company valuations. Conversely, in an environment of declining interest rates, the company might benefit from lower borrowing costs and increased demand for its lending products.

Interesting facts about the company

📈 Want to read more about OFS Capital?

Sign up for free

or

log in

🚀 Don’t miss "The Checklist Value Investor — A Smarter Way to Pick Stocks" — free!

CiAgICAgIC AgICAgIDxk aXYgc3R5bG U9J3dpZHRo OiAxMDAlOy BkaXNwbGF5 OiBmbGV4Oy BqdXN0aWZ5 LWNvbnRlbn Q6IGNlbnRl cjsnPgogIC AgICAgICAg ICAgICAgPG RpdiBzdHls ZT0nCiAgIC AgICAgICAg ICAgICAgIC AgZGlzcGxh eTogZmxleD sKICAgICAg ICAgICAgIC AgICAgICBh bGlnbi1pdG VtczogY2Vu dGVyOwogIC AgICAgICAg ICAgICAgIC AgIGJhY2tn cm91bmQtY2 9sb3I6ICNm MGY0Zjg7Ci AgICAgICAg ICAgICAgIC AgICAgYm9y ZGVyOiAxcH ggc29saWQg I2QxZTNmMD sKICAgICAg ICAgICAgIC AgICAgICBi b3JkZXItcm FkaXVzOiAx MHB4OwogIC AgICAgICAg ICAgICAgIC AgIHBhZGRp bmc6IDEwcH g7CiAgICAg ICAgICAgIC AgICAgICAg bWFyZ2luOi AyMHB4IDA7 CiAgICAgIC AgICAgICAg ICAgICAgZm 9udC1mYW1p bHk6ICJTZW dvZSBVSSIs IFJvYm90by wgc2Fucy1z ZXJpZjsKIC AgICAgICAg ICAgICAgIC AgICBib3gt c2hhZG93Oi AwIDJweCA2 cHggcmdiYS gwLCAwLCAw LCAwLjA1KT sKICAgICAg ICAgICAgIC AgICAgICBt YXgtd2lkdG g6IDkwMHB4 OwogICAgIC AgICAgICAg ICAgICAgIH dpZHRoOiAx MDAlOyc+Cg ogICAgICAg ICAgICAgIC AgICAgIDxp bWcgc3JjPS Jhc3NldHMv bG9nb3MvWG NLM1Z5dWpN ZlNWWG1sbE dmbkcud2Vi cCIgYWx0PS JPRlMgQ2Fw aXRhbCIgdG l0bGU9Ik9G UyBDYXBpdG FsIiAgY2xh c3M9ImltZy 1mbHVpZCIg aGVpZ2h0PT kwIHdpZHRo PTkwIGxvYW Rpbmc9J2xh enknIHN0eW xlPSdib3Jk ZXItcmFkaX VzOiA2cHg7 Jz4KCiAgIC AgICAgICAg ICAgICAgIC AgPGRpdiBz dHlsZT0nZm xleDogMTsg dGV4dC1hbG lnbjogY2Vu dGVyOyBtYX JnaW4tbGVm dDogNXB4Oy c+CiAgICAg ICAgICAgIC AgICAgICAg ICAgIDxwIH N0eWxlPSdm b250LXNpem U6IDI2cHg7 IGNvbG9yOi AjMzMzOyBt YXJnaW4tYm 90dG9tOiAx NXB4Oyc+Ci AgICAgICAg ICAgICAgIC AgICAgICAg ICAgICDwn5 OIIFdhbnQg dG8gcmVhZC Btb3JlIGFi b3V0IE9GUy BDYXBpdGFs PwogICAgIC AgICAgICAg ICAgICAgIC AgICA8L3A+ CgogICAgIC AgICAgICAg ICAgICAgIC AgICA8YSBo cmVmPSdpbm RleC5waHA/ cGFnZT1zaW dudXAnIHN0 eWxlPScKIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgIGJhY2 tncm91bmQt Y29sb3I6IC MwMDdCRkY7 CiAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICBj b2xvcjogI2 ZmZjsKICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgIHBhZGRp bmc6IDEwcH ggMjBweDsK ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgIGJv cmRlci1yYW RpdXM6IDVw eDsKICAgIC AgICAgICAg ICAgICAgIC AgICAgICAg IHRleHQtZG Vjb3JhdGlv bjogbm9uZT sKICAgICAg ICAgICAgIC AgICAgICAg ICAgICAgIG ZvbnQtd2Vp Z2h0OiBib2 xkOwogICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgbWFyZ2lu LXJpZ2h0Oi AxMHB4Owog ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgdHJh bnNpdGlvbj ogYmFja2dy b3VuZC1jb2 xvciAwLjNz IGVhc2U7Jw ogICAgICAg ICAgICAgIC AgICAgICAg ICAgICAgb2 5tb3VzZW92 ZXI9J3RoaX Muc3R5bGUu YmFja2dyb3 VuZENvbG9y PSIjMDA1Nm IzIicKICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgIG9ubW91 c2VvdXQ9J3 RoaXMuc3R5 bGUuYmFja2 dyb3VuZENv bG9yPSIjMD A3QkZGIic+ CiAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICBT aWduIHVwIG ZvciBmcmVl CiAgICAgIC AgICAgICAg ICAgICAgIC AgIDwvYT4K CiAgICAgIC AgICAgICAg ICAgICAgIC AgIDxzcGFu IHN0eWxlPS dtYXJnaW46 IDAgOHB4Oy Bjb2xvcjog IzU1NTsnPm 9yPC9zcGFu PgoKICAgIC AgICAgICAg ICAgICAgIC AgICAgPGEg aHJlZj0naW 5kZXgucGhw P3BhZ2U9bG 9naW4nIHN0 eWxlPScKIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgIGNvbG 9yOiAjMDA3 QkZGOwogIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgdGV4dC 1kZWNvcmF0 aW9uOiB1bm RlcmxpbmU7 CiAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICBm b250LXdlaW dodDogNTAw Oyc+CiAgIC AgICAgICAg ICAgICAgIC AgICAgICAg ICBsb2cgaW 4KICAgICAg ICAgICAgIC AgICAgICAg ICAgPC9hPg oKCiAgICAg ICAgICAgIC AgICAgICAg ICAgIDxwIH N0eWxlPSdt YXJnaW4tdG 9wOiAxNXB4 OyBmb250LX NpemU6IDEz cHg7IGZvbn Qtd2VpZ2h0 OiBib2xkOy Bjb2xvcjog I2QzMmYyZj snPgogICAg ICAgICAgIC AgICAgICAg ICAgICAgIC Ag8J+ZjCBK b2luIG5vdy B0byBnZXQg PGk+IlRoZS BDaGVja2xp c3QgVmFsdW UgSW52ZXN0 b3Ig4oCUIE EgU21hcnRl ciBXYXkgdG 8gUGljayBT dG9ja3MiPC 9pPiBhdCBu byBjb3N0Ci AgICAgICAg ICAgICAgIC AgICAgICAg IDwvcD4KCi AgICAgICAg ICAgICAgIC AgICAgICAg IDwhLS0KIC AgICAgICAg ICAgICAgIC AgICAgICAg PGRpdiBzdH lsZT0nbWFy Z2luLXRvcD ogMTJweDsg Zm9udC1zaX plOiAxM3B4 OyBjb2xvcj ogIzQ0NDsn PgogICAgIC AgICAgICAg ICAgICAgIC AgICAgICAg U2lnbiB1cC Bub3cgYW5k IGdldCBvdX IgZnJlZSBl Qm9vayAKIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgIDxiPl RoZSBDaGVj a2xpc3QgVm FsdWUgSW52 ZXN0b3Ig4o CUIEEgU21h cnRlciBXYX kgdG8gUGlj ayBTdG9ja3 M8L2I+CiAg ICAgICAgIC AgICAgICAg ICAgICAgID wvZGl2Pgog ICAgICAgIC AgICAgICAg ICAgICAgIC AtLT4KICAg ICAgICAgIC AgICAgICAg ICAgICAgPC EtLQogICAg ICAgICAgIC AgICAgICAg ICAgICA8ZG l2IHN0eWxl PSdtYXJnaW 4tdG9wOiAx NnB4OyBmb2 50LXNpemU6 IDE0cHg7IG NvbG9yOiAj NDQ0OyBmb2 50LWZhbWls eTogLWFwcG xlLXN5c3Rl bSwgQmxpbm tNYWNTeXN0 ZW1Gb250LC BTZWdvZSBV SSwgUm9ib3 RvLCBIZWx2 ZXRpY2EgTm V1ZSwgc2Fu cy1zZXJpZj sgbGluZS1o ZWlnaHQ6ID EuNjsnPgog ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgSGF2 ZSB5b3UgaG VhcmQgYWJv dXQgb3VyIH Nob3J0IDxz dHJvbmcgc3 R5bGU9J2Zv bnQtd2VpZ2 h0OiA2MDA7 Jz5EYWlseS BWaWRlbyBO ZXdzbGV0dG VyPC9zdHJv bmc+PwogIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgPGEgaH JlZj0naHR0 cHM6Ly93d3 cuaW5zaWdo dGZ1bHZhbH VlLmNvbS9u ZXdzbGV0dG VyLnBocCcg dGFyZ2V0PS dfYmxhbmsn IHN0eWxlPS djb2xvcjog IzAwN0JGRj sgdGV4dC1k ZWNvcmF0aW 9uOiBub25l OyBmb250LX dlaWdodDog NTAwOyBtYX JnaW4tbGVm dDogNnB4Oy c+CiAgICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgRmlu ZCBvdXQgbW 9yZQogICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgPC9hPgog ICAgICAgIC AgICAgICAg ICAgICAgIC A8L2Rpdj4K ICAgICAgIC AgICAgICAg ICAgICAgIC AgLS0+CiAg ICAgICAgIC AgICAgICAg ICAgPC9kaX Y+CiAgICAg ICAgICAgIC AgICA8L2Rp dj4KICAgIC AgICAgICAg PC9kaXY+Ci AgICAgICAg ICAgIAogIC AgICAgIAog ICAgICAgID xzcGFuIGNs YXNzPSdibH VycmVkLXRl eHQnPgogIC AgICAgICAg ICBNUzRnUm 05MWJtIFJs WkNCcGJpQX kgTURBMkxD QlBSbCBNZ1 EyRndhWFJo IGJDQnBjeU JoSUggQjFZ bXhwWTJ4NS BJSFJ5WVdS bFpDIEJpZF hOcGJtVnog Y3lCa1pYWm xiRyA5d2JX VnVkQ0JqIG IyMXdZVzU1 SUMgaENSRU 1wSUhSbyBZ WFFnYVhNZ1 ltIEZ6WldR Z2FXNGcgUT JocFkyRm5i eSB3Z1NXeH NhVzV2IGFY TXVQR0p5UG ogSXVJRlJv WlNCaiBiMj F3WVc1NUlI IEJ5YVcxaG NtbHMgZVNC bWIyTjFjMi BWeklHOXVJ R2x1IGRtVn pkR2x1Wnkg QnBiaUJ0YV dSayBiR1V0 YldGeWEyIF YwSUdOdmJY QmggYm1sbG N5QjNhWCBS b0lHRnVibl ZoIGJDQnla WFpsYm4gVm xjeUJpWlhS MyBaV1Z1SU NReE1DIEJ0 YVd4c2FXOX UgSUdGdVpD QWtNaiBVd0 lHMXBiR3hw IGIyNHVQR0 p5UGogTXVJ RTlHVXlCRC BZWEJwZEdG c0lIIEJ5YV cxaGNtbHMg ZVNCd2NtOT JhVyBSbGN5 Qm1hVzVoIG JtTnBibWNn YVcgNGdkR2 hsSUdadiBj bTBnYjJZZ2 MyIFZ1YVc5 eUlITmwgWT NWeVpXUWdi RyA5aGJuTX NJRzFsIGVu cGhibWx1Wl MgQmtaV0ow TENCaCBibV FnWlhGMWFY IFI1SUdsdW RtVnogZEcx bGJuUnpMai B4aWNqNDBM aUJVIGFHVW dZMjl0Y0cg RnVlZUtBbV hNZyBhVzUy WlhOMGJXIF Z1ZENCd2Iz SjAgWm05c2 FXOGdhWCBN Z1pHbDJaWE p6IGFXWnBa V1FnWVcgTn liM056SUdF ZyBkbUZ5YV dWMGVTIEJ2 WmlCcGJtUj EgYzNSeWFX VnpMQyBCcG JtTnNkV1Jw IGJtY2dhR1 ZoYkggUm9Z MkZ5WlN3Zy BZblZ6YVc1 bGMzIE1nYz JWeWRtbGog WlhNc0lHRn VaQyBCcGJt UjFjM1J5IG FXRnNJRzFo Ym4gVm1ZV0 4wZFhKcCBi bWN1UEdKeV BqIFV1SUVG eklHOW0gSU ZObGNIUmxi VyBKbGNpQX lNREl4IExD QlBSbE1nUT IgRndhWFJo YkNCbyBZV1 FnWVhCd2Nt IDk0YVcxaG RHVnMgZVNB a056Y3pJRy AxcGJHeHBi MjRnIGFXNG dkRzkwWVcg d2dZWE56Wl hSeiBJSFZ1 WkdWeUlHID FoYm1GblpX MWwgYm5RdV BHSnlQaiBZ dUlFbHVJR0 ZrIFpHbDBh Vzl1SUggUn ZJR2wwY3lC cCBiblpsYz NSdFpXIDUw SUdGamRHbD IgYVhScFpY TXNJRSA5R1 V5QkRZWEJw IGRHRnNJRz ltWm0gVnlj eUIyWVd4MS BaUzFoWkdS bFpDIEJ6Wl hKMmFXTmwg Y3lCMGJ5Qn BkSCBNZ2NH OXlkR1p2IG JHbHZJR052 YlggQmhibW xsY3l3ZyBj M1ZqYUNCaG N5IEJtYVc1 aGJtTnAgWV d3Z1lXNWtJ SCBOMGNtRj BaV2RwIFl5 QnpkWEJ3Yj MgSjBManhp Y2o0MyBMaU JVYUdVZ1ky IDl0Y0dGdW VTQnAgY3lC bGVIUmxjbS A1aGJHeDVJ RzFoIGJtRm 5aV1FnWW4g a2dUMFpUSU VOaCBjR2ww WVd3Z1RXIE Z1WVdkbGJX VnUgZEN3Z1 RFeERMQyBC aElITjFZbk 5wIFpHbGhj bmtnYjIgWW dUMFpUSUVO aCBjR2wwWV d3Z1EyIDl5 Y0c5eVlYUn AgYjI0dVBH SnlQaiBndU lFOUdVeUJE IFlYQnBkR0 ZzSUUgTnZj bkJ2Y21GMC BhVzl1SUds eklHIHhwYz NSbFpDQnYg YmlCMGFHVW dUbSBGelpH RnhJSE4wIG IyTnJJR1Y0 WTIgaGhibW RsSUhWdSBa R1Z5SUhSb1 pTIEIwYVdO clpYSWcgYz NsdFltOXNJ TyBLQW5FOU dVeTdpIGdK MDhZbkkrT1 MgNGdWR2hs SUdOdiBiWE JoYm5uaWdK IGx6SUcxaG JtRm4gWlcx bGJuUWdkRy BWaGJTQm9Z WE1nIFpYaD BaVzV6YVgg WmxJR1Y0Y0 dWeSBhV1Z1 WTJVZ2FXID RnY0hKcGRt RjAgWlNCbG NYVnBkSCBr Z1lXNWtJRz FwIFpHUnNa UzF0WVggSn JaWFFnYkdW dSBaR2x1Wn l3Z2QyIGww YUNCaGJpQm ggZG1WeVlX ZGxJRyA5bU lHOTJaWEln IE1qQWdlV1 ZoY24gTWdi MllnWlhody BaWEpwWlc1 alpTIEJwYm lCMGFHVWcg YVc1a2RYTj BjbiBrdVBH SnlQakV3IE xpQlBSbE1n UTIgRndhWF JoYkNCbyBZ WE1nYjJabW FXIE5sY3lC cGJpQkQgYU dsallXZHZM QyBCT1pYY2 dXVzl5IGF5 d2dZVzVrSU UgeHZjeUJC Ym1kbCBiR1 Z6TENCaGJH IHh2ZDJsdV p5QnAgZENC MGJ5Qm9ZWC BabElHRWdi bUYwIGFXOX VZV3dnY20g VmhZMmdnWV c1ayBJR0Zq WTJWemN5IE IwYnlCaElI ZHAgWkdVZ2 RtRnlhVyBW MGVTQnZaaU JwIGJuWmxj M1J0WlcgNT BJRzl3Y0c5 eSBkSFZ1YV hScFpYIE11 SUR4aWNqND 0KICAgICAg ICA8L3NwYW 4+CiAgICAg ICAgCiAgIC AgICAg

See Company Q&A

📊 Get full analytics about OFS Capital

Sign up for free

or

log in

📚 Your free copy of "The Checklist Value Investor — A Smarter Way to Pick Stocks" is waiting