Company at a Glance

Price

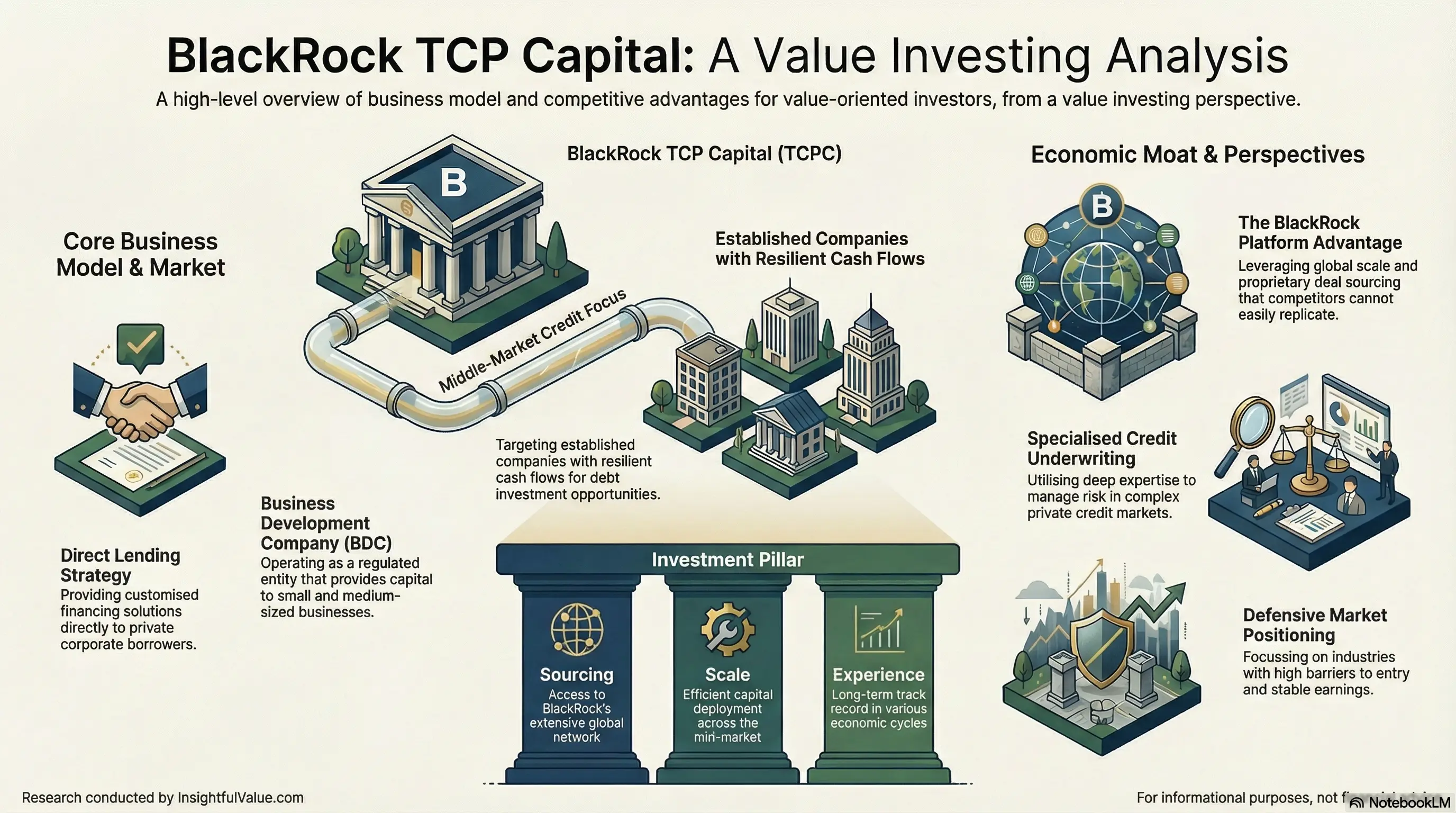

Infographic

Overview

BlackRock TCP Capital, also known as TCP Capital, is an investment firm that provides capital to middle market companies. It was established in 1999 and is headquartered in Santa Monica, California. The company is a public company and is listed on the NASDAQ exchange under the ticker symbol TCPC.

TCP Capital focuses on providing flexible financing solutions to privately-held companies with strong fundamentals and growth potential. It primarily invests in senior secured loans, mezzanine debt, and equity investments.

The company is part of the BlackRock family of funds, one of the largest asset management firms in the world. In addition to its investment activities, TCP Capital also offers financial and operational support to its portfolio companies in order to help them achieve their growth objectives.

TCP Capital’s investment portfolio is diverse and includes companies from various industries such as healthcare, energy, technology, and consumer goods. As of December 31, 2021, the company’s investment portfolio had a fair value of approximately $1.9 billion.

TCP Capital is led by a team of experienced investment professionals with backgrounds in finance, private equity, and investment banking. The company’s board of directors includes individuals with extensive experience in the financial industry.

TCP Capital is committed to responsible and ethical business practices, and it is a signatory of the United Nations Principles for Responsible Investment. The company also has a strong commitment to corporate governance and transparency, regularly disclosing its financial results and investment activities to its shareholders.

In addition to its investment activities, TCP Capital also has a strong commitment to giving back to the community. The company has a philanthropic program that supports various organizations and initiatives focused on education, healthcare, and economic empowerment.

What is special about the company?

📈 Want to read more about BlackRock TCP Capital?

Sign up for free

or

log in

📥 Get our free eBook now: "The Checklist Value Investor — A Smarter Way to Pick Stocks"

MS4gRm9jdX NlZCBvbiBt aWRkbGUtbW Fya2V0IGxl bmRpbmc6IE JsYWNrUm9j ayBUQ1AgQ2 FwaXRhbCBz cGVjaWFsaX plcyBpbiBw cm92aWRpbm cgZmluYW5j aW5nIHNvbH V0aW9ucyB0 byBtaWRkbG UtbWFya2V0 IGNvbXBhbm llcywgd2hp Y2ggb2Z0ZW 4gaGF2ZSBs aW1pdGVkIG FjY2VzcyB0 byB0cmFkaX Rpb25hbCBi YW5rIGxvYW 5zIG9yIHB1 YmxpYyBjYX BpdGFsIG1h cmtldHMuPG JyPjIuIEV4 cGVyaWVuY2 VkIGludmVz dG1lbnQgdG VhbTogVGhl IGNvbXBhbn nigJlzIGlu dmVzdG1lbn QgdGVhbSBo YXMgYW4gYX ZlcmFnZSBv ZiBvdmVyID IwIHllYXJz IG9mIGV4cG VyaWVuY2Ug aW4gdGhlIG 1pZGRsZS1t YXJrZXQgbG VuZGluZyBz cGFjZSwgZ2 l2aW5nIHRo ZW0gZGVlcC BleHBlcnRp c2UgYW5kIG Egc3Ryb25n IG5ldHdvcm sgaW4gdGhl IGluZHVzdH J5Ljxicj4z LiBEaXZlcn NlIGludmVz dG1lbnQgcG 9ydGZvbGlv OiBCbGFja1 JvY2sgVENQ IENhcGl0YW wgaW52ZXN0 cyBpbiBhIH ZhcmlldHkg b2YgaW5kdX N0cmllcywg aW5jbHVkaW 5nIHRlY2hu b2xvZ3ksIG hlYWx0aGNh cmUsIGNvbn N1bWVyIHBy b2R1Y3RzLC BhbmQgZW5l cmd5LCBhbG xvd2luZyBm b3IgZGl2ZX JzaWZpY2F0 aW9uIGFuZC ByaXNrIG1h bmFnZW1lbn QuPGJyPjQu IFN0cm9uZy BmaW5hbmNp YWwgcGVyZm 9ybWFuY2U6 IFRoZSBjb2 1wYW55IGhh cyBhIHRyYW NrIHJlY29y ZCBvZiBkZW xpdmVyaW5n IGNvbnNpc3 RlbnQgcmV0 dXJucyB0by BzaGFyZWhv bGRlcnMgdG hyb3VnaCBp dHMgZGlzY2 lwbGluZWQg dW5kZXJ3cm l0aW5nIHBy b2Nlc3MgYW 5kIGFjdGl2 ZSBwb3J0Zm 9saW8gbWFu YWdlbWVudC 48YnI+NS4g UmVsYXRpb2 5zaGlwLW9y aWVudGVkIG FwcHJvYWNo OiBVbmxpa2 UgdHJhZGl0 aW9uYWwgYm Fua3MsIEJs YWNrUm9jay BUQ1AgQ2Fw aXRhbCB0YW tlcyBhIHBh cnRuZXJzaG lwIGFwcHJv YWNoIHRvd2 FyZHMgaXRz IGJvcnJvd2 VycywgcHJv dmlkaW5nIG N1c3RvbWl6 ZWQgZmluYW 5jaW5nIHNv bHV0aW9ucy B0YWlsb3Jl ZCB0byB0aG Ugc3BlY2lm aWMgbmVlZH Mgb2YgZWFj aCBjb21wYW 55Ljxicj42 LiBCYWNrZW QgYnkgQmxh Y2tSb2NrOi BBcyBhIHN1 YnNpZGlhcn kgb2YgQmxh Y2tSb2NrLC B0aGUgbGFy Z2VzdCBpbn Zlc3RtZW50 IG1hbmFnZW 1lbnQgZmly bSBpbiB0aG Ugd29ybGQs IEJsYWNrUm 9jayBUQ1Ag Q2FwaXRhbC BoYXMgYWNj ZXNzIHRvIH NpZ25pZmlj YW50IHJlc2 91cmNlcyBh bmQgZXhwZX J0aXNlLCBw cm92aWRpbm cgc3RhYmls aXR5IGFuZC BjcmVkaWJp bGl0eSB0by B0aGUgY29t cGFueS48Yn I+Ny4gQ29t bWl0bWVudC B0byByZXNw b25zaWJsZS BpbnZlc3Rp bmc6IFRoZS Bjb21wYW55 IGhhcyBhIH N0cm9uZyBm b2N1cyBvbi BlbnZpcm9u bWVudGFsLC Bzb2NpYWws IGFuZCBnb3 Zlcm5hbmNl IChFU0cpIH ByaW5jaXBs ZXMgYW5kIG hhcyBiZWVu IHJlY29nbm l6ZWQgZm9y IGl0cyBjb2 1taXRtZW50 IHRvIHJlc3 BvbnNpYmxl IGludmVzdG luZyBieSB2 YXJpb3VzIG luZHVzdHJ5 IG9yZ2FuaX phdGlvbnMu PGJyPjguIE NvbnNpc3Rl bnQgZGl2aW RlbmQgcGF5 bWVudHM6IE JsYWNrUm9j ayBUQ1AgQ2 FwaXRhbCBo YXMgYSBoaX N0b3J5IG9m IHBheWluZy BzdGVhZHkg ZGl2aWRlbm RzIHRvIHNo YXJlaG9sZG VycywgcHJv dmlkaW5nIG EgcmVsaWFi bGUgaW5jb2 1lIHN0cmVh bSBmb3IgaW 52ZXN0b3Jz Ljxicj45Li BUcmFuc3Bh cmVuY3kgYW 5kIGRpc2Ns b3N1cmU6IF RoZSBjb21w YW55IHByb3 ZpZGVzIHRy YW5zcGFyZW 50IGFuZCBk ZXRhaWxlZC ByZXBvcnRp bmcgdG8gaX RzIHNoYXJl aG9sZGVycy wgYWxsb3dp bmcgZm9yIG EgY2xlYXIg dW5kZXJzdG FuZGluZyBv ZiBpdHMgaW 52ZXN0bWVu dCBzdHJhdG VneSBhbmQg cGVyZm9ybW FuY2UuPGJy PjEwLiBTdH JvbmcgY29y cG9yYXRlIG N1bHR1cmU6 IEJsYWNrUm 9jayBUQ1Ag Q2FwaXRhbC BoYXMgYSBz dHJvbmcgY2 9ycG9yYXRl IGN1bHR1cm UgdGhhdCBm b2N1c2VzIG 9uIGludGVn cml0eSwgdG VhbXdvcmss IGFuZCBoaW doIGV0aGlj YWwgc3Rhbm RhcmRzLCBj cmVhdGluZy BhIHBvc2l0 aXZlIHdvcm sgZW52aXJv bm1lbnQgZm 9yIGl0cyBl bXBsb3llZX Mu

What the company's business model?

📈 Want to read more about BlackRock TCP Capital?

Sign up for free

or

log in

📖 Get insights from "The Checklist Value Investor — A Smarter Way to Pick Stocks" now!

VGhlIEJsYW NrUm9jayBU Q1AgQ2FwaX RhbCBjb21w YW55LCBhbH NvIGtub3du IGFzIFRlbm 5lbmJhdW0g Q2FwaXRhbC BQYXJ0bmVy cywgaXMgYS BwdWJsaWNs eS10cmFkZW QgYnVzaW5l c3MgZGV2ZW xvcG1lbnQg Y29tcGFueS AoQkRDKSB0 aGF0IHNwZW NpYWxpemVz IGluIHByb3 ZpZGluZyBk ZWJ0IGFuZC BlcXVpdHkg Y2FwaXRhbC B0byBtaWRk bGUtbWFya2 V0IGNvbXBh bmllcyBpbi B0aGUgVW5p dGVkIFN0YX Rlcy4gVGhl aXIgbWFpbi BidXNpbmVz cyBtb2RlbC ByZXZvbHZl cyBhcm91bm QgbWFraW5n IGludmVzdG 1lbnRzIGlu IHByaXZhdG UgY29tcGFu aWVzLCB0eX BpY2FsbHkg cmFuZ2luZy Bmcm9tICQx MCBtaWxsaW 9uIHRvICQ1 MCBtaWxsaW 9uLCBhbmQg Z2VuZXJhdG luZyByZXR1 cm5zIHRocm 91Z2ggdGhl IGludGVyZX N0IGFuZCBk aXZpZGVuZH MgcGFpZCBv biB0aGVzZS BpbnZlc3Rt ZW50cywgYX Mgd2VsbCBh cyB0aHJvdW doIGNhcGl0 YWwgYXBwcm VjaWF0aW9u IHVwb24gZX hpdC4gVGhl eSBhbHNvIG 9mZmVyIGZp bmFuY2lhbC BhZHZpc29y eSBhbmQgY2 9uc3VsdGlu ZyBzZXJ2aW NlcyB0byB0 aGVpciBwb3 J0Zm9saW8g Y29tcGFuaW VzLiBUaGVp ciBvYmplY3 RpdmUgaXMg dG8gZ2VuZX JhdGUgY29u c2lzdGVudC BhbmQgc3Rh YmxlIHJldH VybnMgZm9y IHRoZWlyIG ludmVzdG9y cyB3aGlsZS BoZWxwaW5n IHRoZWlyIH BvcnRmb2xp byBjb21wYW 5pZXMgZ3Jv dyBhbmQgc3 VjY2VlZC4=

Sensitivity to interest rates

The sensitivity of BlackRock TCP Capital’s earnings, cash flow, and valuation to changes in interest rates can be significant due to the nature of its business as a publicly traded business development company (BDC) that primarily invests in debt securities, particularly in the private middle-market sector.

1. Earnings Sensitivity: The earnings of BlackRock TCP Capital are sensitive to interest rate changes because a considerable portion of its income comes from interest on loans. When interest rates rise, the yield on new loans can increase, potentially boosting earnings. However, if rates rise too quickly, it might also increase the cost of debt for borrowers, which could lead to higher default risks and impairments on existing loans, negatively impacting overall earnings.

2. Cash Flow Sensitivity: Changes in interest rates can also significantly affect cash flow. Higher interest rates might lead to improved cash flow from new loans due to higher interest income; conversely, if borrowers face higher costs, cash flows may be challenged by increased defaults or payment delays. Additionally, the company’s own borrowing costs can rise with increasing interest rates, which could squeeze cash flow if the company has variable-rate debt.

3. Valuation Sensitivity: The valuation of BlackRock TCP Capital is influenced by interest rates through the discount rate applied to its projected cash flows. Higher interest rates generally lead to higher discount rates, which can reduce the present value of future cash flows and, hence, lower the valuation. Additionally, the market tends to react to changes in interest rates, which can lead to fluctuations in the stock price and valuation multiples applied to the company.

Overall, while rising interest rates can potentially enhance income from new investments, they also bring risks related to borrower defaults and higher funding costs that can negatively affect earnings, cash flows, and overall valuation. The net impact largely depends on the balance between these factors, as well as the market context at any given time.

Interesting facts about the company

📈 Want to read more about BlackRock TCP Capital?

Sign up for free

or

log in

💡 Learn smarter stock picks with "The Checklist Value Investor — A Smarter Way to Pick Stocks"

CiAgICAgIC AgICAgIDxk aXYgc3R5bG U9J3dpZHRo OiAxMDAlOy BkaXNwbGF5 OiBmbGV4Oy BqdXN0aWZ5 LWNvbnRlbn Q6IGNlbnRl cjsnPgogIC AgICAgICAg ICAgICAgPG RpdiBzdHls ZT0nCiAgIC AgICAgICAg ICAgICAgIC AgZGlzcGxh eTogZmxleD sKICAgICAg ICAgICAgIC AgICAgICBh bGlnbi1pdG VtczogY2Vu dGVyOwogIC AgICAgICAg ICAgICAgIC AgIGJhY2tn cm91bmQtY2 9sb3I6ICNm MGY0Zjg7Ci AgICAgICAg ICAgICAgIC AgICAgYm9y ZGVyOiAxcH ggc29saWQg I2QxZTNmMD sKICAgICAg ICAgICAgIC AgICAgICBi b3JkZXItcm FkaXVzOiAx MHB4OwogIC AgICAgICAg ICAgICAgIC AgIHBhZGRp bmc6IDEwcH g7CiAgICAg ICAgICAgIC AgICAgICAg bWFyZ2luOi AyMHB4IDA7 CiAgICAgIC AgICAgICAg ICAgICAgZm 9udC1mYW1p bHk6ICJTZW dvZSBVSSIs IFJvYm90by wgc2Fucy1z ZXJpZjsKIC AgICAgICAg ICAgICAgIC AgICBib3gt c2hhZG93Oi AwIDJweCA2 cHggcmdiYS gwLCAwLCAw LCAwLjA1KT sKICAgICAg ICAgICAgIC AgICAgICBt YXgtd2lkdG g6IDkwMHB4 OwogICAgIC AgICAgICAg ICAgICAgIH dpZHRoOiAx MDAlOyc+Cg ogICAgICAg ICAgICAgIC AgICAgIDxp bWcgc3JjPS Jhc3NldHMv bG9nb3MvSF BLR0w2cFhM TElBa2pPcl p4SVIud2Vi cCIgYWx0PS JCbGFja1Jv Y2sgVENQIE NhcGl0YWwi IHRpdGxlPS JCbGFja1Jv Y2sgVENQIE NhcGl0YWwi ICBjbGFzcz 0iaW1nLWZs dWlkIiBoZW lnaHQ9OTAg d2lkdGg9OT AgbG9hZGlu Zz0nbGF6eS cgc3R5bGU9 J2JvcmRlci 1yYWRpdXM6 IDZweDsnPg oKICAgICAg ICAgICAgIC AgICAgICA8 ZGl2IHN0eW xlPSdmbGV4 OiAxOyB0ZX h0LWFsaWdu OiBjZW50ZX I7IG1hcmdp bi1sZWZ0Oi A1cHg7Jz4K ICAgICAgIC AgICAgICAg ICAgICAgIC AgPHAgc3R5 bGU9J2Zvbn Qtc2l6ZTog MjZweDsgY2 9sb3I6ICMz MzM7IG1hcm dpbi1ib3R0 b206IDE1cH g7Jz4KICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgIPCfk4gg V2FudCB0by ByZWFkIG1v cmUgYWJvdX QgQmxhY2tS b2NrIFRDUC BDYXBpdGFs PwogICAgIC AgICAgICAg ICAgICAgIC AgICA8L3A+ CgogICAgIC AgICAgICAg ICAgICAgIC AgICA8YSBo cmVmPSdpbm RleC5waHA/ cGFnZT1zaW dudXAnIHN0 eWxlPScKIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgIGJhY2 tncm91bmQt Y29sb3I6IC MwMDdCRkY7 CiAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICBj b2xvcjogI2 ZmZjsKICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgIHBhZGRp bmc6IDEwcH ggMjBweDsK ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgIGJv cmRlci1yYW RpdXM6IDVw eDsKICAgIC AgICAgICAg ICAgICAgIC AgICAgICAg IHRleHQtZG Vjb3JhdGlv bjogbm9uZT sKICAgICAg ICAgICAgIC AgICAgICAg ICAgICAgIG ZvbnQtd2Vp Z2h0OiBib2 xkOwogICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgbWFyZ2lu LXJpZ2h0Oi AxMHB4Owog ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgdHJh bnNpdGlvbj ogYmFja2dy b3VuZC1jb2 xvciAwLjNz IGVhc2U7Jw ogICAgICAg ICAgICAgIC AgICAgICAg ICAgICAgb2 5tb3VzZW92 ZXI9J3RoaX Muc3R5bGUu YmFja2dyb3 VuZENvbG9y PSIjMDA1Nm IzIicKICAg ICAgICAgIC AgICAgICAg ICAgICAgIC AgIG9ubW91 c2VvdXQ9J3 RoaXMuc3R5 bGUuYmFja2 dyb3VuZENv bG9yPSIjMD A3QkZGIic+ CiAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICBT aWduIHVwIG ZvciBmcmVl CiAgICAgIC AgICAgICAg ICAgICAgIC AgIDwvYT4K CiAgICAgIC AgICAgICAg ICAgICAgIC AgIDxzcGFu IHN0eWxlPS dtYXJnaW46 IDAgOHB4Oy Bjb2xvcjog IzU1NTsnPm 9yPC9zcGFu PgoKICAgIC AgICAgICAg ICAgICAgIC AgICAgPGEg aHJlZj0naW 5kZXgucGhw P3BhZ2U9bG 9naW4nIHN0 eWxlPScKIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgIGNvbG 9yOiAjMDA3 QkZGOwogIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgdGV4dC 1kZWNvcmF0 aW9uOiB1bm RlcmxpbmU7 CiAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICBm b250LXdlaW dodDogNTAw Oyc+CiAgIC AgICAgICAg ICAgICAgIC AgICAgICAg ICBsb2cgaW 4KICAgICAg ICAgICAgIC AgICAgICAg ICAgPC9hPg oKCiAgICAg ICAgICAgIC AgICAgICAg ICAgIDxwIH N0eWxlPSdt YXJnaW4tdG 9wOiAxNXB4 OyBmb250LX NpemU6IDEz cHg7IGZvbn Qtd2VpZ2h0 OiBib2xkOy Bjb2xvcjog I2QzMmYyZj snPgogICAg ICAgICAgIC AgICAgICAg ICAgICAgIC Ag8J+SoSBM ZWFybiBzbW FydGVyIHN0 b2NrIHBpY2 tzIHdpdGgg PGk+IlRoZS BDaGVja2xp c3QgVmFsdW UgSW52ZXN0 b3Ig4oCUIE EgU21hcnRl ciBXYXkgdG 8gUGljayBT dG9ja3MiPC 9pPgogICAg ICAgICAgIC AgICAgICAg ICAgICA8L3 A+CgogICAg ICAgICAgIC AgICAgICAg ICAgICA8IS 0tCiAgICAg ICAgICAgIC AgICAgICAg ICAgIDxkaX Ygc3R5bGU9 J21hcmdpbi 10b3A6IDEy cHg7IGZvbn Qtc2l6ZTog MTNweDsgY2 9sb3I6ICM0 NDQ7Jz4KIC AgICAgICAg ICAgICAgIC AgICAgICAg ICAgIFNpZ2 4gdXAgbm93 IGFuZCBnZX Qgb3VyIGZy ZWUgZUJvb2 sgCiAgICAg ICAgICAgIC AgICAgICAg ICAgICAgIC A8Yj5UaGUg Q2hlY2tsaX N0IFZhbHVl IEludmVzdG 9yIOKAlCBB IFNtYXJ0ZX IgV2F5IHRv IFBpY2sgU3 RvY2tzPC9i PgogICAgIC AgICAgICAg ICAgICAgIC AgICA8L2Rp dj4KICAgIC AgICAgICAg ICAgICAgIC AgICAgLS0+ CiAgICAgIC AgICAgICAg ICAgICAgIC AgIDwhLS0K ICAgICAgIC AgICAgICAg ICAgICAgIC AgPGRpdiBz dHlsZT0nbW FyZ2luLXRv cDogMTZweD sgZm9udC1z aXplOiAxNH B4OyBjb2xv cjogIzQ0ND sgZm9udC1m YW1pbHk6IC 1hcHBsZS1z eXN0ZW0sIE JsaW5rTWFj U3lzdGVtRm 9udCwgU2Vn b2UgVUksIF JvYm90bywg SGVsdmV0aW NhIE5ldWUs IHNhbnMtc2 VyaWY7IGxp bmUtaGVpZ2 h0OiAxLjY7 Jz4KICAgIC AgICAgICAg ICAgICAgIC AgICAgICAg IEhhdmUgeW 91IGhlYXJk IGFib3V0IG 91ciBzaG9y dCA8c3Ryb2 5nIHN0eWxl PSdmb250LX dlaWdodDog NjAwOyc+RG FpbHkgVmlk ZW8gTmV3c2 xldHRlcjwv c3Ryb25nPj 8KICAgICAg ICAgICAgIC AgICAgICAg ICAgICAgID xhIGhyZWY9 J2h0dHBzOi 8vd3d3Lmlu c2lnaHRmdW x2YWx1ZS5j b20vbmV3c2 xldHRlci5w aHAnIHRhcm dldD0nX2Js YW5rJyBzdH lsZT0nY29s b3I6ICMwMD dCRkY7IHRl eHQtZGVjb3 JhdGlvbjog bm9uZTsgZm 9udC13ZWln aHQ6IDUwMD sgbWFyZ2lu LWxlZnQ6ID ZweDsnPgog ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgICAg IEZpbmQgb3 V0IG1vcmUK ICAgICAgIC AgICAgICAg ICAgICAgIC AgICAgIDwv YT4KICAgIC AgICAgICAg ICAgICAgIC AgICAgPC9k aXY+CiAgIC AgICAgICAg ICAgICAgIC AgICAgIC0t PgogICAgIC AgICAgICAg ICAgICAgID wvZGl2Pgog ICAgICAgIC AgICAgICAg PC9kaXY+Ci AgICAgICAg ICAgIDwvZG l2PgogICAg ICAgICAgIC AKICAgICAg ICAKICAgIC AgICA8c3Bh biBjbGFzcz 0nYmx1cnJl ZC10ZXh0Jz 4KICAgICAg ICAgICAgTV M0Z1FteGhZ MiB0U2IyTn JJRlJEIFVD QkRZWEJwZE cgRnNJQ2ht YjNKdCBaWE pzZVNCcmJt IDkzYmlCaG N5QlUgWlc1 dVpXNWlZWC BWdElFTmhj R2wwIFlXd2 dVR0Z5ZEcg NWxjbk1wSU dseiBJR0Z1 SUdGc2RHIF Z5Ym1GMGFY WmwgSUdsdW RtVnpkRyAx bGJuUWdiV0 Z1IFlXZGxi V1Z1ZEMgQm 1hWEp0SUhS byBZWFFnYz NCbFkyIGxo YkdsNlpYTW cgYVc0Z2NI SnZkbSBsa2 FXNW5JR1Js IFluUWdZVz VrSUcgVnhk V2wwZVNCbS BhVzVoYm1O cGJtIGNnZE c4Z2JXbGsg Wkd4bExXMW hjbSB0bGRD QmpiMjF3IF lXNXBaWE11 UEcgSnlQak l1SUZSbyBa U0JqYjIxd1 lXIDU1SUhk aGN5Qm0gYj NWdVpHVmtJ RyBsdUlERT VPVGtnIFlu a2dTRzkzWV ggSmtJRTFo Y210eiBJR0 Z1WkNCQ2Nu IFZqWlNCTF lYSnogYUN3 Z2RIZHZJRy BadmNtMWxj aUJsIGVHVm pkWFJwZG0g VnpJR0YwSU ZSbyBaU0JV UTFjZ1IzIE p2ZFhBdVBH SnkgUGpNdU lFSnNZVyBO clVtOWpheU JVIFExQWdR MkZ3YVggUm hiQ0JwY3lC aSBZWE5sWk NCcGJpIEJN YjNNZ1FXNW 4gWld4bGN5 d2dRMiBGc2 FXWnZjbTVw IFlTQmhibV FnYUcgRnpJ RzltWm1sai BaWE1nYVc0 Z1RtIFYzSU ZsdmNtc3Mg SUVOb2FXTm haMiA4c0lH RnVaQ0JNIG IyNWtiMjR1 UEcgSnlQal F1SUVGeiBJ RzltSURJd0 1qIEVzSUVK c1lXTnIgVW 05amF5QlVR MSBBZ1EyRn dhWFJoIGJD Qm9ZWE1nWV ggQndjbTk0 YVcxaCBkR1 ZzZVNBa055 IEJpYVd4c2 FXOXUgSUds dUlHRnpjMi BWMGN5QjFi bVJsIGNpQn RZVzVoWjIg VnRaVzUwTG p4aSBjajQx TGlCVWFHIF VnWTI5dGNH RnUgZVNCbW IyTjFjMiBW eklHOXVJR2 x1IGRtVnpk R2x1WnkgQn BiaUJqYjIx dyBZVzVwWl hNZ2FXIDRn YVc1a2RYTj AgY21sbGN5 QnpkVyBOb0 lHRnpJR2hs IFlXeDBhR0 5oY20gVXNJ SFJsWTJodS BiMnh2WjNr c0lHIFpwYm 1GdVkybGgg YkNCelpYSj JhVyBObGN5 d2dZVzVrIE lHVnVaWEpu ZVMgNDhZbk krTmk0ZyBR bXhoWTJ0U2 IyIE5ySUZS RFVDQkQgWV hCcGRHRnNJ SCBCeWFXMW hjbWxzIGVT QnBiblpsYz MgUnpJR2x1 SUdacCBjbk 4wSUdGdVpD IEJ6WldOdm JtUWcgYkds bGJpQnNiMi BGdWN5d2di V1Y2IGVtRn VhVzVsSUcg UmxZblFzSU dGdSBaQ0Js Y1hWcGRIIG tnYzJWamRY SnAgZEdsbG N5QnZaaSBC dGFXUmtiR1 V0IGJXRnlh MlYwSUcgTn ZiWEJoYm1s bCBjeTQ4WW 5JK055IDRn VkdobElHTn YgYlhCaGJu a2dhWCBNZ2 NIVmliR2xq IGJIa2dkSE poWkcgVmtJ Rzl1SUhSby BaU0JPUVZO RVFWIEVnZF c1a1pYSWcg ZEdobElIUn BZMiB0bGNp QnplVzFpIG Iyd2dWRU5R UXkgNDhZbk krT0M0ZyBT VzRnTWpBeE 55IHdnUW14 aFkydFMgYj JOcklGUkRV QyBCRFlYQn BkR0ZzIElH MWxjbWRsWk MgQjNhWFJv SUVKcyBZV0 5yVW05amF5 IEJMWld4em J5QkQgWVhC cGRHRnNMQy BCaGJtOTBh R1Z5IElHSj FjMmx1Wlgg TnpJR1JsZG 1WcyBiM0J0 Wlc1MElHIE 52YlhCaGJu a3MgSUhSdk lHWnZjbSAw Z2IyNWxJRz ltIElIUm9a U0JzWVggSm 5aWE4wSUdG dSBaQ0J0Yj NOMElHIFJw ZG1WeWMybG 0gYVdWa0lF SkVRMyBNZ2 FXNGdkR2hs IElHMWhjbX RsZEMgNDhZ bkkrT1M0Zy BRbXhoWTJ0 U2IyIE5ySU ZSRFVDQkQg WVhCcGRHRn NJRyBseklH dHViM2R1IE lHWnZjaUJw ZEggTWdZMj l1YzJWeSBk bUYwYVhabE lHIEZ1WkNC a2FYTmogYV hCc2FXNWxa QyBCcGJuWm xjM1J0IFpX NTBJR0Z3Y0 ggSnZZV05v TENCMyBhR2 xqYUNCb1lY IE1nY21Wem RXeDAgWldR Z2FXNGdZUy BCMGNtRmph eUJ5IFpXTn ZjbVFnYjIg WWdjM1JoWW 14bCBJR0Z1 WkNCemRIIE p2Ym1jZ2Nt VjAgZFhKdW N5Qm1iMyBJ Z2FYUnpJR2 x1IGRtVnpk Rzl5Y3kgND hZbkkrTVRB dSBJRlJvWl NCamIyIDF3 WVc1NUlHaG ggY3lCaElH UnBkbSBWeW MyVWdaM0p2 IGRYQWdiMl lnYzIgaGhj bVZvYjJ4ay BaWEp6TENC M2FYIFJvSU dsdWMzUnAg ZEhWMGFXOX VZVyB3Z2FX NTJaWE4wIG IzSnpJRzFo YTIgbHVaeU IxY0NCMCBh R1VnYldGcW IzIEpwZEhr Z2IyWWcgYV hSeklHOTNi bSBWeWMyaH BjQzQ9CiAg ICAgICAgPC 9zcGFuPgog ICAgICAgIA ogICAgICAg IA==

See Company Q&A

📊 Get full analytics about BlackRock TCP Capital

Sign up for free

or

log in

👥 Free eBook for new users: "The Checklist Value Investor — A Smarter Way to Pick Stocks"